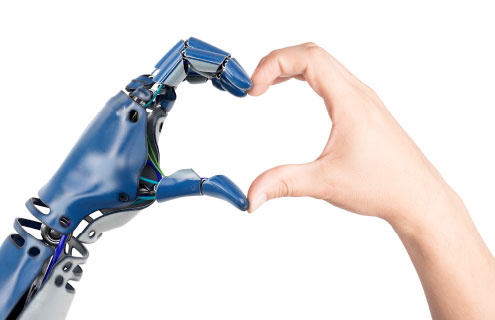

Ian McGregor, vice president of sales for Europe, Middle East and Africa at UiPath, explains why captive insurers need to grasp the benefits of robotic process automation

Ian McGregor, vice president of sales for Europe, Middle East and Africa at UiPath, explains why captive insurers need to grasp the benefits of robotic process automation

Captive insurers increasingly offer genuine flexibility in financing the newer, and potentially more severe, risks that businesses now face. Data breaches, cybercrime and terrorism to name but three.

It seems inevitable that as this market appetite increases, more businesses facing these risks will use the skills and unique capabilities of the captive sector.

These new market opportunities require creative responses so that practitioners can come up with competitive propositions more quickly and profitably. The problem, as ever, is that innovation is usually in short-supply when it takes so much time and energy to keep the engine running.

Advantages

The big question is whether the captive insurance industry has grasped the potential of robotics. Most mainstream commercial insurers are already deploying software robots in claims and applications processing, achieving more than 60 percent increases in productivity and 95 percent increases in accuracy while simultaneously reducing costs. Innovative businesses are also moving into the automation of decision making in front-office functions such as underwriting.

In the captive insurance industry there is plenty of emphasis on boosting efficiency and reducing costs through implementation of enterprise-level management software. There is also significant expectation about future blockchain-related applications, as blockchain currently promises more than it delivers.

Yet this does not remove many of the problems faced by captive insurers, which they share with their traditional, commercial counterparts. Many insurers now find themselves having to operate with legacy systems that are too rigid and outdated to cope within an increasingly onerous and complex regulatory environment.

The majority are stuck attempting to innovate on enterprise applications that are between 10 and 30 years old. These systems simply cannot provide the flexibility required, because they were never designed with the capabilities required in today’s insurance market.

The cost of complacency

There are rumblings among captive insurers that the investment and risk associated with upgrading legacy systems are prohibitive. In the case of robotic process automation (RPA), this is mistaken. Not only does this technology connect them with the capabilities and features that are essential to remaining agile and competitive, it also allows them to support existing enterprise application integration and business process management architecture while integrating core systems and ancillary software applications in a non-invasive way.

One insurance company, for instance, handles thousands of customer inquiries across two call centres each month. Dealing with direct sales, claims status requests and claims submissions, the business has transformed its operations through an RPA platform that fully integrates with its back-office systems and databases.

Inevitably, when considering such a far-reaching project there were fears about the cost, the length of the project and the risk that it might not pay off. However, with RPA, the fears around each of these challenges have proved to be unfounded. Combining the ability to interface (as humans do) with Citrix, mainframe, and legacy automation technologies, the complexity and cost of back-office issues are easily solved.

For the insurer referenced above, the results spoke for themselves. Agent-assist workstation robots have led to productivity gains of more than 30 percent.

Removing drudgery and boosting profitability

In the captive insurance market, robots will introduce dramatic efficiencies by automating a wide range of routine operational activities such as analysing submissions emails and documents, extracting and loading risk data, dispatching emails to underwriters and actuaries, as well as handling claims processing and financial reconciliations.

Through automation, reinsurers are already achieving 100 percent processing accuracy with the complete elimination of human error. The speed of processing has led to a reduction of 80 percent in the amount of time taken for one reinsurer to achieve reconciliation of monthly bank statements, saving the equivalent of 25 percent of full-time-equivalent staff.

Software robots after all, never need to stop and they allow every process to be monitored with a full audit trail. Their ability to tackle complex routine processes frees talented staff for more creative activities and for the implementation of profitable initiatives to meet changing market demand.

They also obviate human resources issues associated with having to retain or retrain staff, which can be a particular challenge in offshore operations.

There can be little doubt that it is time for captives to turn their attention to RPA so they can unlock the talents of their staff and boost profitability by freeing them from time-consuming, boring and costly drudge-work.

.jpg)