Kumar Bhaskar has worked for IPFS Canada for more than nine years, most recently serving as senior vice president

The collaboration aims to provide comprehensive coverage options that meet the needs of businesses within the medical health spa industry, and address evolving risks in the sector

Gail Newman from Bright Horizons and Joe Carter from United Educators are re-elected to a second term and appointed as new chair and vice chair

Andrew Sullivan has more than 12 years of experience in the insurance industry across roles in distribution, management consulting, and transformation

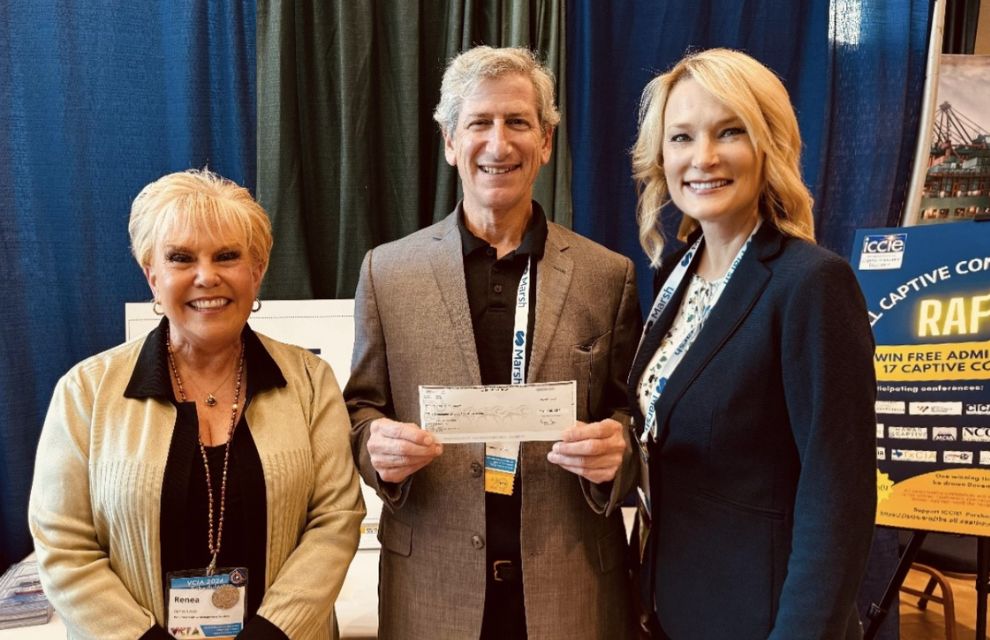

This contribution marks a continuation of WRCIC’s commitment to excellence in captive education, with donations over the years totalling more than US$10,000

The coverage includes the issuance of US$163 million of insurance-linked notes and US$41 million of direct reinsurance

Nick Nudo joins Aon from SCOR, where he worked for over 14 years, most recently as chief underwriting officer of reinsurance in North America

Donald Ashwood is also a board member of the Oklahoma Captive Insurance Association and the Western Region Captive Insurance Conference

The product, available to projects globally, addresses critical insurance limitations that have previously hindered the rapid advancement of the carbon capture and storage industry

Skyward Specialty delivers commercial property and casualty products and solutions to global clients, including captives

Meanwhile Insurance Bitcoin is the first and only life insurer in the world that operates entirely in the cryptocurrency

Global reinsurance market reset to de-risk portfolios, realign carrier relationships, and improve pricing led to strong technical results in 2023, according to AM Best