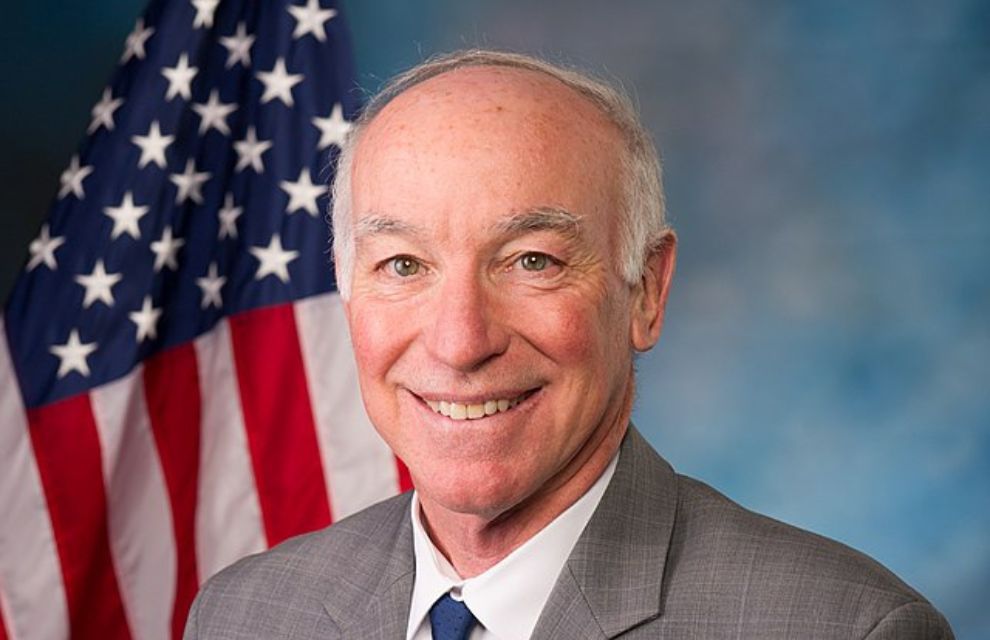

Connecticut representative Joe Courtney has introduced the Casualty Loss Deduction Restoration Act to provide citizens with financial relief following losses from unexpected disasters. The act has been established alongside a number of bipartisan, bicameral lawmakers. It seeks to restore pre-2018 regulations, whereby taxpayers were granted tax relief following unexpected disasters and casualty loss through the casualty loss deduction for uninsured casualty losses. The act includes losses resulting from crumbling foundations, one of the key issues Courtney aims to address in his role. Currently, only taxpayers with a Presidential Disaster Declaration, delivered by the Federal Emergency Management Agency, are eligible for tax assistance in these circumstances. The act was been co-sponsored by Rep. Joe Courtney (D-CT), Rep. John Larson (D-CT), Rep. Dan Crenshaw (R-TX), Rep. Mike Rogers (R-AL), Rep. Julia Brownley (D-CA), Senator Richard Blumenthal (D-CT), Senator Chris Murphy (D-CT), Senator Ed Markey (D-MA), Senator Elizabeth Warren (D-MA) and Senator Bill Cassidy (R-LA). Courtney says: “Since the crumbling foundations crisis showed its face, my office has worked non-stop to find solutions and deliver support for affected communities. Homeowners have felt the push and pull of progress in Congress, and many have been left with exorbitant costs after a key method of relief—the casualty loss deduction—was eliminated in 2018. “With our new bill, homeowners would once again be able to claim a casualty loss deduction and receive tax relief. I am confident we can advance this bill and support families who have incurred losses at no fault of their own.”