Catastrophe bond issuance totalled more than $4 billion in Q2 2018, the third largest Q2 total in history, according to a report from Aon Benfield.

Q2 is traditionally the largest in terms of cat bond issuance volume due to the high amounts of US wind-exposed capacity purchased.

Aon’s Q2 2018 Update on insurance-linked securities (ILS) also revealed that the total outstanding cat bond limit was in excess of $30 billion as of 30 June 2018—a record high for the market.

The report also showed that the quarter had a record volume of maturating bonds, with nearly $3 billion of limit coming off-risk, this capital was, however, entirely replaced, and even expanded through $1 billion in new issuance volume.

Cat bond pricing was lower than the levels seen in the 2017 catastrophes, with a weighted average multiple at issuance (issuance spread divided by expected loss) of 2.46 times for this quarter, in comparison to 2.58 in Q2 2017.

With the exception of Transatlantic Re, which entered the market in May with its Bowline 2018-1 offering, issuances came almost exclusively from repeat sponsors.

Despite the volume of repeat sponsor issuance, the report stated that there were a number of “notable issuances and trends observed in the quarter”.

The newly-created London ILS regime was made use of for the first time, with the incorporation of the first UK-based vehicle for SCOR’s latest Atlas transaction.

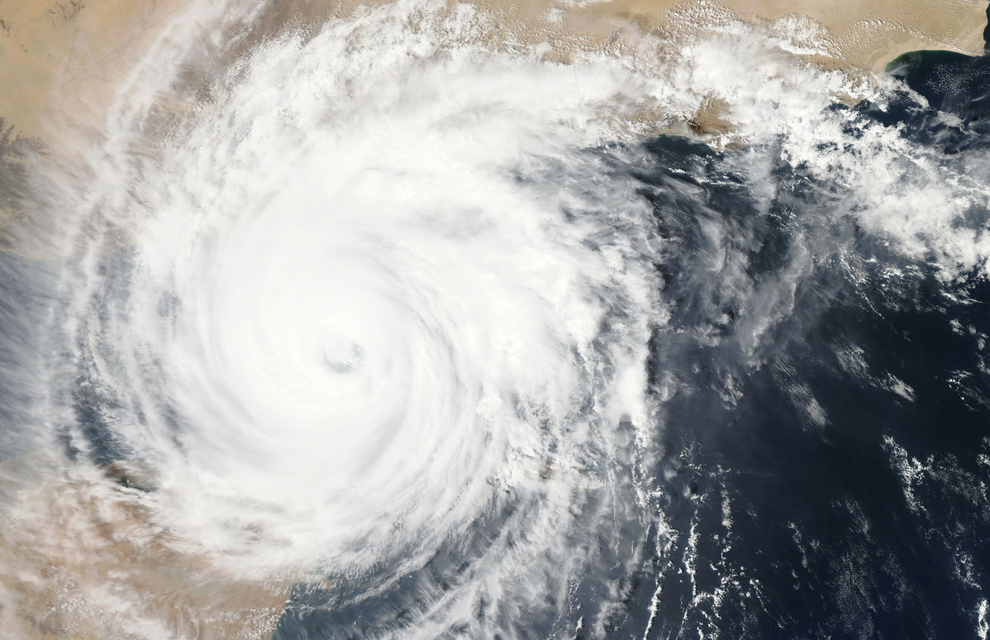

Another notable trend was the continued usage of the cat bond market from coastal windpools, which had exposure at risk to hurricanes Harvey, Irma, and Maria in 2017.

A sponsor that had been absent from the cat bond market for almost 10 years returned with the issue in Kendall Re for Aspen and an issue which had ceded losses in previous bonds successfully came back with Caelus Re V on behalf of Nationwide.

The report appeared positive on the current state of the cat bond market and stated: “Given the 2017 US wind loss events, this strong result evidences the continued utility of catastrophe bonds for sponsors and investors alike, and demonstrates the continued robustness of the insurance-linked securities sector.”