Shares of Blue Capital Reinsurance (BCRH) fell sharply following its market debut.

The newly issued stock dropped $1.25, or 6.3 percent, to $18.75 at the end of trading. In the same time the broader markets rose.

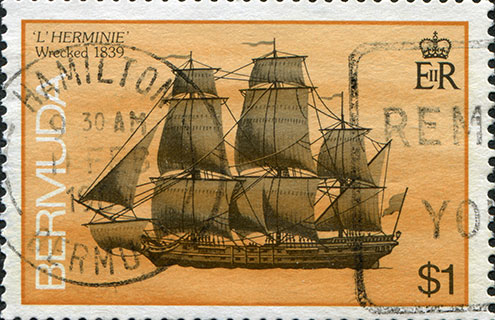

BCRH is a newly formed Bermuda-based reinsurance holding company seeking to offer collateralised reinsurance in the property catastrophe market. The company is a unit of Montpelier Re.

The company said in a statement that the initial public offering of 6.3 million shares was priced as expected by analysts at $20 per share.

BCRH will compete directly with both local and global reinsurance firms, as well as capital markets participants, including Aeolus Capital Management, Credit Suisse, Lloyd's, RenaissanceRe and Validus Holdings.

The listing of Blue Capital is a rare opportunity for investors looking to access the returns of a collateralised catastrophe reinsurance business via shareholdings.

The company raised $126 million in the IPO.

Blue Capital has yet to respond for a request to comment on the IPO.